ABSTRACT

The dream of studying abroad is undeniably alluring, promising world-class education, profound cultural immersion, and unparalleled personal growth. Yet, beneath this exciting prospect lies a significant and often underestimated challenge: managing the financial realities. For many aspiring international students, the cost of studying abroad can seem like a formidable barrier, a complex web of tuition fees, living expenses, and hidden costs that are difficult to predict. Financial miscalculations are a common pitfall, leading to undue stress, compromised academic performance, and, in some unfortunate cases, the premature abandonment of a global education dream. Despite extensive planning, students often find their budgets stretched thin by unforeseen expenses or a lack of comprehensive financial foresight.

As a Digital Architect, I understand that the success of any complex system hinges on the robustness of its underlying financial architecture. A flawed budget, much like a poorly designed database, can lead to system collapse, regardless of the brilliance of the overall vision. The journey of studying abroad is precisely such a system, and sound financial planning is its critical backbone. This article aims to demystify the true cost of studying abroad for 2025 students. We will dissect the core components of these expenses, explore the intricate ecosystem of financial variables, and share practical insights gleaned from observing countless international student journeys. Our goal is to equip you with a robust framework to architect your fiscal success, ensuring your global academic adventure is not just possible, but financially sustainable and stress-free.

DISSECTING THE CORE ARCHITECTURE: THE MULTI-FACETED COSTS OF GLOBAL EDUCATION

Understanding the true cost of studying abroad goes far beyond just tuition fees. It involves a comprehensive breakdown of various financial components, each contributing to the overall expenditure. Approaching this with a clear understanding of each element is the first step in building a resilient financial plan. Think of these as the fundamental modules in your financial architecture.

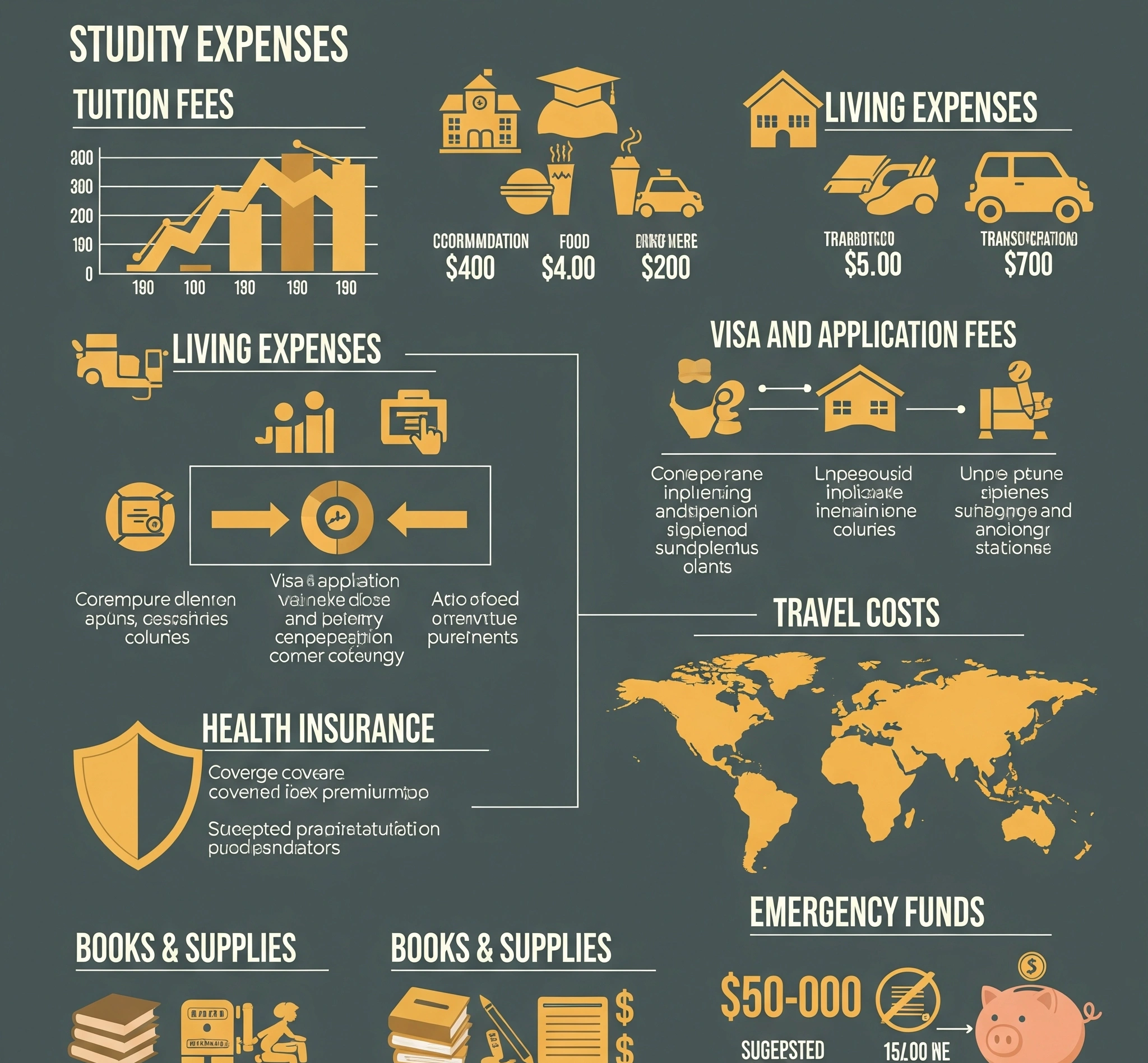

1. Tuition Fees (The Primary Investment)

This is often the largest single expense. Tuition fees vary dramatically by country, institution type (public vs. private), program level (undergraduate, graduate), and field of study. For instance, public universities in Germany or Nordic countries might offer free or very low tuition, even for international students, while top universities in the US or UK can charge tens of thousands of dollars annually. Research specific program fees thoroughly, as these can be subject to annual increases.

2. Living Expenses (Daily Operational Costs)

These are your day-to-day costs and typically represent the second largest expense. This category includes:

- Accommodation: Rent for on-campus dorms, off-campus apartments, or shared housing. Prices vary significantly by city and type of accommodation.

- Food: Groceries, dining out, and meal plans. Cooking at home is generally more economical than eating out frequently.

- Transportation: Public transport passes, bicycle rentals, or occasional ride-shares. Costs depend on your commute distance and city’s infrastructure.

- Utilities: Electricity, water, heating, internet, and mobile phone plans. These are often separate from rent in off-campus housing.

- Personal Expenses: Toiletries, clothing, entertainment, social activities, and incidental purchases. These costs are highly variable based on lifestyle.

It’s crucial to research average living costs for the specific city you plan to study in, not just the country. Major metropolitan areas are almost always more expensive.

3. Visa and Application Fees (Entry and Processing Costs)

Before you even leave, there are administrative costs. These include university application fees (which can add up if you apply to multiple institutions), standardized test fees (IELTS, TOEFL, SAT, GRE, GMAT), and, most significantly, student visa application fees. Some countries also require a visa processing fee or a specific “blocked account” deposit to prove financial capability, which, while refundable, ties up a significant amount of capital initially.

4. Health Insurance (Essential Safety Net)

International students are almost always required to have health insurance. Some countries have national health systems that cover students (e.g., in Europe), while others require private insurance. The cost and coverage vary widely. Do not underestimate this expense; adequate health coverage is vital for your well-being and a mandatory requirement for your visa in most cases.

5. Travel Costs (Initial and Ongoing Logistics)

This includes the cost of airfare to your study destination, which can be substantial, especially for long-haul flights. Factor in baggage fees, airport transfers, and potentially a return ticket if required by your visa. Also, consider the cost of travel during holidays or emergencies if you plan to visit home.

6. Books and Supplies (Academic Tools)

While some universities provide digital resources, many programs still require textbooks, stationery, software licenses, or specialized equipment. Budget for these academic necessities, as they can add up over the course of a semester or year.

7. Miscellaneous and Emergency Funds (The Contingency Buffer)

Always allocate a buffer for unforeseen expenses. This could include initial setup costs (bedding, kitchenware), unexpected medical needs, or emergency travel. A robust financial plan includes a contingency fund to absorb these shocks without derailing your budget. This acts as a critical fail-safe in your financial architecture.

DYNAMIC FINANCIAL VARIABLES

The financial landscape of studying abroad is not static; it’s a dynamic ecosystem influenced by various external factors. A successful budget plan must account for these variables, adapting to changes and mitigating risks. Ignoring this broader ecosystem is a common reason why even well-intentioned budgets fall short.

1. Exchange Rates and Currency Fluctuations (The Volatility Factor)

Your home currency’s strength against the host country’s currency directly impacts your purchasing power. Favorable exchange rates can make your funds go further, while unfavorable shifts can quickly erode your budget. Monitor exchange rate trends and consider strategies like locking in rates for large payments or using multi-currency accounts if available. This is a critical, often overlooked, variable in your financial ecosystem.

2. Inflation and Cost of Living Increases (The Erosion Factor)

The cost of goods and services can increase over time due to inflation. While you budget based on current figures, prices for food, transport, and rent may rise during your study period. Factor in a small percentage for annual increases when planning your long-term budget. This foresight helps prevent budget erosion over time.

3. Scholarship and Financial Aid Landscape (The Funding Stream)

The availability and terms of scholarships and financial aid are crucial. Some scholarships cover full costs, while others are partial. Understand the disbursement schedule of any aid you receive. Will it be paid directly to the university, or to you? Monthly, quarterly, or annually? This impacts your cash flow management. Actively seeking and applying for relevant scholarships is a proactive way to secure funding streams within this ecosystem.

4. Part-time Work Regulations and Opportunities (The Income Variable)

Many countries allow international students to work part-time (e.g., 20 hours per week during term, full-time during breaks). However, regulations vary, and job availability can be competitive. Do not solely rely on part-time work to cover significant portions of your core expenses, especially initially. It should be considered supplementary income. Research local minimum wages and typical student job opportunities in your target city. Also, be aware of any tax implications on your earnings.

5. Unexpected Expenses and Emergencies (The Unpredictability Factor)

Life abroad, like life anywhere, is unpredictable. Emergencies (medical, family), unexpected travel, or sudden price increases can strain your budget. A robust financial ecosystem includes a dedicated emergency fund, separate from your regular living expenses. This buffer is your critical fail-safe against unforeseen circumstances.

6. Tax Implications (The Hidden Deduction)

Depending on your nationality and the host country’s tax treaties, you might be subject to taxes on scholarships, stipends, or part-time earnings. Researching these implications beforehand can prevent unexpected deductions from your funds. Some countries also have specific tax benefits or exemptions for international students.

PROJECT SIMULATION – THE CASE OF SARA

To truly understand the impact of comprehensive budget planning, let’s consider “Sara,” an ambitious student from Vietnam who received an acceptance letter from a reputable university in Australia for her Master’s degree in Public Health. She had secured a partial scholarship covering about 40% of her tuition. Initially, Sara felt confident, believing her scholarship and a small amount of family savings would suffice.

The Initial Budgeting Oversight

Sara’s initial budget was rudimentary. She focused heavily on the remaining tuition and estimated basic rent, food, and transport. However, she significantly underestimated the cost of living in a major Australian city. She didn’t account for initial setup costs (bond for apartment, furniture, kitchenware), health insurance premiums, visa processing fees, or the higher cost of groceries compared to her home country. Furthermore, she planned to rely heavily on part-time work, without fully understanding the competitive job market or the 20-hour weekly limit for international students during term time.

Within her first two months, Sara found her savings rapidly depleting. Unexpected costs for textbooks, a mandatory health check for her visa extension, and higher-than-expected utility bills created immense financial pressure. She spent valuable study time searching for jobs, often taking low-paying roles that barely covered her immediate needs. This financial strain began to affect her academic performance and overall well-being. Her financial “system” was crashing due to unaddressed vulnerabilities.

Architecting a Resilient Financial Solution

Recognizing her precarious situation, Sara sought help from her university’s international student support office. We advised her to adopt a rigorous “Fiscal Architect” approach to rebuild her financial plan:

- Comprehensive Cost Mapping: First, Sara created a detailed spreadsheet, mapping out *all* potential expenses, including the often-overlooked initial setup costs, health insurance specifics, and a realistic buffer for miscellaneous items. She used official university estimates and online cost-of-living calculators for her city.

- Income Stream Diversification: She re-evaluated her income. While part-time work was still a goal, she identified smaller, more attainable scholarships specific to her field or background that she could apply for. She also had a frank discussion with her family to explore if a small, consistent monthly contribution was feasible, even if modest.

- Dynamic Budgeting and Tracking: Sara implemented a strict monthly budget, categorizing every expense. She used a budgeting app to track her spending daily, comparing it against her plan. This allowed her to identify areas of overspending immediately and adjust. For example, she discovered that eating out even once a week significantly impacted her food budget, so she prioritized cooking at home.

- Proactive Financial Literacy: She attended workshops on financial management for international students offered by her university. She learned about student discounts, how to save on groceries, and efficient public transport options. She also gained a better understanding of tax obligations for international students.

- Contingency Planning: She committed to building a small emergency fund, even if it meant cutting back on non-essential spending. This provided a psychological safety net and reduced anxiety.

The Breakthrough

Within three months, Sara’s financial situation stabilized. Her meticulous tracking allowed her to regain control. She found a stable part-time job that fit her study schedule, and the additional small scholarships provided crucial supplementary income. By understanding every financial component and actively managing her budget, she transformed her experience. The stress diminished, her academic focus returned, and she was able to fully enjoy her study abroad journey, proving that proactive financial architecture is as vital as academic preparation.

WHY BUDGETS FAIL (BEYOND LACK OF FUNDS)

Even students with seemingly adequate funds often face financial distress abroad. This isn’t always due to a lack of money, but rather an “open code” of underlying behavioral and systemic issues that undermine even the most robust financial plans. Understanding these less obvious pitfalls is crucial for building a truly resilient budget.

1. Underestimation of “Soft” Costs and Social Spending

Students frequently budget for tuition, rent, and food, but severely underestimate “soft” costs. These include social activities, dining out with new friends, weekend trips, shopping, and entertainment. The desire to fully immerse oneself in the cultural experience can lead to impulsive spending that quickly depletes funds. This category is often the first to be overlooked but can have the most significant impact on daily liquidity.

2. Over-Reliance on Unsecured Part-time Income

Many students plan to cover a significant portion of their living expenses through part-time work. However, they often fail to secure a job before arrival, underestimate the competitiveness of the local job market, or don’t account for the time it takes to find suitable employment. Furthermore, strict visa regulations on working hours can limit earning potential. Relying on an uncertain income stream for essential expenses is a major financial vulnerability.

3. Ignoring Currency Fluctuations and Transaction Fees

The dynamic nature of exchange rates can silently erode your budget. A slight weakening of your home currency against the host currency means your money buys less. Additionally, students often overlook hidden transaction fees for international transfers, ATM withdrawals, and foreign currency conversions. These small, frequent deductions can accumulate significantly over time, acting as a hidden drain on funds.

4. Lack of a Dynamic Budget and Regular Tracking

A budget isn’t a one-time document; it’s a living system that requires constant monitoring and adjustment. Many students create an initial budget but fail to track their actual spending or review their financial situation regularly. Without this dynamic feedback loop, overspending in one area can go unnoticed until it becomes a crisis. This static approach to budgeting is a recipe for financial strain.

5. Emotional Spending and Homesickness Mitigation

Adjusting to a new country can be emotionally taxing. Homesickness, stress, or the desire to “fit in” can lead to emotional spending – buying comforts from home, excessive socializing, or impulsive purchases to alleviate loneliness. While understandable, these behaviors can quickly derail a budget if not managed consciously. Recognizing this psychological aspect of spending is vital.

6. Inadequate Emergency Fund (The Missing Fail-Safe)

Life throws curveballs. An unexpected medical bill, a sudden need for a flight home, or a lost essential item can trigger a financial crisis if no emergency fund is in place. Many students budget to the exact penny, leaving no buffer for unforeseen circumstances. This lack of a financial fail-safe is a critical design flaw in their budget architecture.

Understanding these “open codes” allows aspiring international students to move beyond simple arithmetic. It empowers them to build a comprehensive, adaptable, and psychologically aware financial plan that can withstand the real-world pressures of studying abroad, ensuring their dream remains fiscally viable.

THE “FISCAL ARCHITECT’S BLUEPRINT”

To architect a truly robust and resilient financial plan for your study abroad journey, I propose the “Fiscal Architect’s Blueprint” Approach. This framework emphasizes proactive planning, continuous monitoring, and strategic adaptation to ensure your financial stability abroad.

1. Comprehensive Cost Assessment (The Foundation Layer):

- Action: Create a detailed spreadsheet or use a budgeting app to list *all* potential expenses: tuition, visa, flights, health insurance, accommodation (rent, bond, utilities), food, transport, books, personal items, and a significant buffer for miscellaneous/emergency costs (aim for 15-20% of total). Use official university and government cost-of-living estimates.

- Benefit: Provides a realistic and holistic view of your financial requirements, preventing initial underestimation.

2. Diversify Funding Sources (The Resource Allocation Layer):

- Action: Actively pursue multiple funding avenues: scholarships (full, partial, niche), grants, student loans (from home or host country, if eligible), family contributions, and realistic part-time work income (research regulations and job market thoroughly).

- Benefit: Reduces reliance on a single source, creating a more stable and resilient financial base.

3. Create a Dynamic Budget (The Operational Layer):

- Action: Develop a monthly or weekly budget. Categorize all expenses (fixed: rent, tuition; variable: food, entertainment). Track every dollar spent using a budgeting app or spreadsheet. Review your budget regularly (weekly/monthly) and adjust based on actual spending and unforeseen circumstances.

- Benefit: Enables real-time financial control, allowing you to identify and address overspending immediately, preventing minor issues from becoming major crises.

4. Hedge Against Fluctuations (The Risk Management Layer):

- Action: Be aware of currency exchange rates. Consider transferring larger sums when the exchange rate is favorable, or explore multi-currency bank accounts if available. Research options for international money transfers with low fees.

- Benefit: Protects your purchasing power from adverse currency movements and minimizes hidden transaction costs.

5. Cultivate Financial Literacy (The Knowledge Layer):

- Action: Learn about banking systems, taxation for international students, and consumer rights in your host country. Seek out student discounts, cheap eats, and free activities. Understand the local cost-saving strategies.

- Benefit: Empowers you to make informed financial decisions, optimize your spending, and avoid common financial pitfalls.

6. Build an Emergency Fund (The Redundancy Layer):

- Action: Prioritize setting aside a dedicated emergency fund (e.g., 3-6 months of essential living expenses) that is separate from your regular budget. This fund is for true emergencies only.

- Benefit: Provides a critical safety net against unforeseen events, offering peace of mind and preventing your academic journey from being derailed by unexpected costs.

By applying the “Fiscal Architect’s Blueprint,” you transform the daunting task of managing study abroad costs into a structured, proactive endeavor. This empowers you to maintain financial stability, reduce stress, and fully immerse yourself in your global academic experience, ensuring your dream is not just realized, but sustained.

FUTURE VISION & AUTHOR BIO

The cost of studying abroad is a significant factor, but it should not be an insurmountable barrier. By adopting a strategic, architectural approach to your financial planning, you transform uncertainty into clarity and potential pitfalls into manageable challenges. As global education continues to evolve, financial models may shift, but the core principles of comprehensive assessment, diversified funding, and diligent management will remain timeless. Embracing the “Fiscal Architect’s Blueprint” not only secures your study abroad journey but also instills invaluable financial literacy and planning skills that will serve you throughout your life. Your global academic adventure is an investment; ensure it’s a sound one, built on a foundation of robust financial foresight.

Ditulis oleh [admin], seorang praktisi AI dengan 10 tahun pengalaman dalam implementasi machine learning di industri finansial. Terhubung di LinkedIn.

Baca juga: Student Visa Requirements for International Students: What You Need to Know